Memorial Day

Applying for your homeowner grant will look a little different compared to 2020. Starting in 2021, all homeowner grant applications will be done directly through the BC Government using their new online portal. Applications are no longer filed through your local municipality; however, you will still receive the homeowner grant application information along with your notice in May 2022. This change from the BC Government was put into effect in 2021.

As a home owner, our Notary, Beverly Carter, decided to test out the process online and surprisingly thought it was easy! Here are some tips that she thinks will make it easier for other home owners, especially help to better understand the numbering system on your tax notice.

Here is what you need to know about the changes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

After you Apply

Additional Information Regarding Homeowner Grants

Questions

Q1: How will I know my homeowner grant has been applied?

A1: You can check the status of your application by calling an agent who will be able to look up your account and let you know if your homeowner grant has been applied to your account.

To speak with an agent you can call 250-387-0555 or toll-free at 1-888-355-2700.

***

Q2: What amount do I pay on my tax notice?

A2: The only change to homeowner grants is how you apply. Instead of applying through your municipality you apply directly through the province.

When you receive your property tax notice, you will see three distinct columns with calculated taxes for different eligibilities. Column A- not eligible for the grant, Column B –eligible for the regular grant, and Column C – seniors/additional grants.

For example, if you qualify for the Homeowner Grant, you will pay the amount calculated for Column B.

***

Q3: Will the BC Government send me a cheque for the amount of my homeowner grant?

A3: No cheque will be sent for the homeowner grant. You pay the tax owing in either column A, B, or C (depending on your eligibility) before the property tax due date. If you are eligible and applied for the homeowner grant, you will pay Column B’s calculated amount which factors in the homeowner grant.

If you pay for the full amount (Column A) but qualify for the homeowner grant you may apply for a refund. You must speak with an agent by calling 250-387-0555. Only then will a cheque be administered in the mail once the refund process is complete.

***

Q4: Is it better to wait to get my tax notice to do this?

A4: Yes, you should wait to receive your notice before applying for the grant. Applications will not be processed until after tax notices have been sent out.

Q5: Should I claim the grant if I am selling my house?

A5: Generally, yes. However, if your house has a firm contract for sale and/or is very close to your completion date (the day the legal transfer of ownership takes place) then check with your Notary Public or lawyer first.

****

Q6: Should I claim the grant if I am purchasing a house?

A6: You cannot claim before you own a house. Discuss this with your Notary Public or lawyer as the homeowner grant may have already been claimed by a seller of the property.

*****

Q7: What is the difference between the Capital Regional District and Capital Assessment Area?

A7: The Capital Regional District includes the 13 municipalities that make up Greater Victoria. These areas have a basic amount of $570.

Capital Assessment Area: they are the rural areas of the province overseen by the Ministry of Finance for tax purposes. They are the areas qualify for the higher grant of $770.

****

Q8: Are there any tips you think we should pass along?

A8: If you unsure about the new application process, you can speak with a representative at 250-387-0555 who will be happy to help you through the application process. And of course, do not forget to pay your taxes on time!

We would like to take the time to acknowledge both our May Newsletter giveaway winners.

Congratulations to Sharon for winning the Wes-Tec Irrigation prize and Angela for winning the Clean House Exterior service.

We would also like to share Angela’s winning comment for being the most creative.

“We have a Boston Beagle. Wikipedia says they are excellent hunting dogs. We should have read Wikipedia first before we fell in love with her and brought her home to (try) and co-exist with our neighborhood deer. She feels that mashing her nose against all our windows will get her just a little closer to those deer in our yard. It doesn’t. But it does make a mess of our windows. Now this doesn’t sound like an exterior window problem until you factor in her cuteness. The kids (and adults; cough, cough) like to boop her nose from the outside of the windows, leading to fingerprints on every, single window she can get to! THAT’S why we would be the perfect candidates for window cleaning from Clean House Exteriors! And they can meet the dog:)”

Angela was also kind enough to share a photo of her Boston Beagle who loves to mash her nose against the window.

Thank you to everyone who entered and good luck with next month’s giveaway.

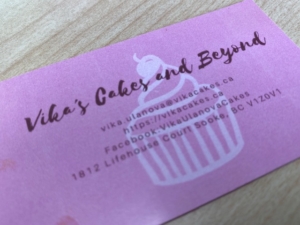

Beverly and the Notary team would like to give one of its clients a huge thank you for gifting us some delicious cake at work today.

The client was so happy with our service for real estate purchases that she rewarded us with this gorgeous cake. Wow! We have so many great clients and we can eat cake too!!

The cake is from “Vikas Cakes and Beyond” and it looks beautiful. This nice lemon and strawberry cake gave us all the extra sugar rush we needed to power through the day and accomplish all your notarization needs.

We are truly thankful for our notary clients who come to us from across the globe. We have received some Merci chocolates as a thank you from a couple of our Francophone customers for helping them with their Estate documents. As much as they appreciate us, we appreciate them too. It is always heartwarming to get a personal note along with chocolates delivered to us. We hold ourselves to the highest level of service standards we can, and it is nice to be appreciated by our clients for noticing our hard work and dedication to our job.

Right now, you could be the rightful owner of a $1.9 Million Estate in BC and you don’t even know. The British Columbia Unclaimed Property Society (BCUPS) has control of an Estate worth $1.9 Million. This is the largest unclaimed account they have ever seen, and it is all because they don’t know what to do with the asset. This is where the importance of keeping your documents up to date can come into play.

In BC alone according to the BCUPS, there are around $177 million of unclaimed assets they have collected over the years. This happens when people forget about their assets and don’t have anyone else claim their estate. This shows the importance of keeping track of your assets.

It is also important to check different countries because there is no universal database where you can see if you have any unclaimed assets around the world. For example, the USA has the National Association of Unclaimed Property Administrators (NAUPA). Considering NAUPA is across the whole USA it was recorded that in 2020 they returned $2.8 Billion worth of property to the rightful owner. Considering the number of people who had property returned to them on average people got around $1,600. That means anyone could have around $1,600 just waiting for them in the USA right now!

It is also important to check for unclaimed estate outside of your continent. For example, in the UK any unclaimed assets go to the Crown. After someone’s death if an asset isn’t claimed it will go on the unclaimed estate list for 30 years. Once the 30 years have passed it will be impossible for anyone to make a claim on the estate.

It is hard to know if you have unclaimed assets in a different part of the world. Therefore, it is always important to keep track of any relatives you might have along with making sure all your financial assets are in place. Keeping track of all possible assets you have own can be challenging but an executor can help you. With assistance from an experienced executor, they could search for any forgotten asset you might not know about.

If you wish to see if you have any unclaimed estate in the British Columbia, go to the website below:

If you wish to see if you have any unclaimed estate in the United States of America, go to the website below:

If you wish to see if you have any unclaimed estate in the United Kingdom, go to the website below:

Your Will can be a very important document to update when you have a drastic change in your financial situation. This lesson is being learned the hard way by the four kids of Frances Lloyd of BC. Shortly before her death Frances won the $3 million lottery and shared some of her winnings. According to court documents she had given two of her four children each at least $500,000 dollars of the lottery winnings.

Winning the lottery is a dream for most people and Frances shared some of her winnings with two of her kids. However, three points stand out in the current court case that can be lessons learned. 1) Frances had no Will. 2) She had a joint account with only one daughter named who did not want to share the contents of the joint account with her siblings. 3) There was a lack of any estate plan. These situations create a lot of uncertainty and lead to the inheritances being decided by the law and it clearly shows what happens when a person dies without a Will. In this case, it has caused the kids to go to court.

With Frances dying so soon after winning the lottery, and her not having a Will, it is not clear what she wanted to happen with the lottery winnings or any other assets. Some would assume that she would want the $3 million divided equally but we will never know her intentions. This shows the importance of having a Will because the Will provides direction as to the equitable or fair inheritance of the assets.

The second lesson within this case is the joint account. The one daughter who was named on her mother’s joint account did not distribute the remaining money to the other kids. In my experience most of the time when parents create a joint account with one of the kids, they usually do it to make it easier to transfer that money or wealth after death – generally speaking, the parents want it to go fairly and equally. When adding a kid to a bank account the inheritance doesn’t have to transfer through the Will or be held up for months through the probate process. But in some cases, you can have a greedy kid who doesn’t distribute the money or feels they are entitled to more, although they were supposed to have given the money to others. Adding a kid as a joint owner of any assets should be documented and identified transparently so that money goes to where it is intended.

The final lesson is the importance of having an estate plan (or, an up-to-date one). These estate plans should include a Will, Power of Attorney, and open conversations with family members about what your intentions are and who are in place for the executor and attorney. Without a Will, there is no one in charge of the division of assets which creates uncertainty. This uncertainty paired with inconsistency can lead to fighting and a legacy of irreparable harm to family relationships.

There is a rise in Will variations disputes and estate litigation in BC, and this is an excellent example. While not everybody is going to win the lottery there are elements here that can be a great lesson you can apply to your life. There is an urban myth that parents believe having or adding kids to bank accounts (or houses) as joint owners is a good thing because they want to avoid the probate process, or they believe that the government is going to take all their assets. This is not the case, while joint ownership has its place, it really needs to be done based on the context of a person’s life.

The court case regarding Frances’s assets is a great learning lesson. It shows the importance of having a Will so it can avoid some messy aftermath. It is also important to update your Will, so any new events won’t cause tough situations for loved ones after you die.

We have created a checklist below on reasons when you should update your Will:

General Checklist for Updating Documents

If you wish to read more about this article Click the link below

Happy Cinco De Mayo from Beverly Carter and the Notary Team!

Being a Notary company we have experience with lots of different international documents. This is why we would like to take the chance and thank our wonderful Mexican clients who choose us for their notary needs. If you need help with any notarizations feel free to reach out to us at https://carternotary.com

We hope everyone has an amazing day. 😀🎉

At Carter Notary, we always try to accommodate our clients to the best of our abilities. Appointments can be made online through Carternotary.com or over the phone at 250-383-4100. We understand that we all can have busy or hectic schedules at times, and that is why we offer drop-in hours weekly (Mon-Fri). Please view our listed drop-in hours HERE.

Think of booking online for a notarization with Carter Notary very much like making a restaurant reservation. It reserves your spot as a priority whereas people who just drop in for a notarization know they may have to wait for a little bit. The system works well and provides flexibility for both our office and its clients. Our clients don’t always know their schedule, they may be running ahead, or they may be running behind. Or they have a tight timeline. No matter the circumstance, we will always try our best to help support and assist your needs. At Carter Notary we thrive on efficient, friendly service.

Click HERE to view our April 2022 Notary Newsletter!

There were some exciting new office announcements, great tips on healthy hearing, and a congratulatory shout-out to the 2022 Douglas 10 to Watch Award Winners.

Our Think Local section features 1 amazing businesses in Greater Victoria, Stratos Performance Nutrition.

Interesting legal industry updates and homestay information for St Andrews Regional Highschool.

Wishing you and your family a great April!

– From Beverly & The Carter Notary Team