Changes to Homeowner Grants 2021

Changes to Homeowner Grants

Attention homeowners! Applying for your homeowner grant will look a little different this year. Starting now, all homeowner grant applications will be done directly through the BC Government using their new online portal. Applications are no longer filed through your local municipality; however, you will still receive the homeowner grant application information along with your notice in May 2021.

As a home owner, our Notary, Beverly Carter, decided to test out the new process online and surprisingly thought it was easy! Here are some tips that she thinks will make it easier for other home owners, especially help to better understand the numbering system on your tax notice.

Here is what you need to know about the changes:

- You may apply for your homeowner grant now but it will not be processed until after tax notices have been mailed out.

- BC Government dedicated online portal to apply is here: https://www.etax.gov.bc.ca/btp/HOG/_/

- For people who do not have computer access, the Homeowner Grant Applications may also be done over the phone or at select Service BC centres.

- To apply online you need to have your property information. We have listed below the jurisdiction numbers for the Greater Victoria and south Vancouver Island area:

- Jurisdiction Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- For all other areas, link here: https://info.bcassessment.ca/services-and-products/Pages/Assessment-Area-Jurisidiction-List.aspx

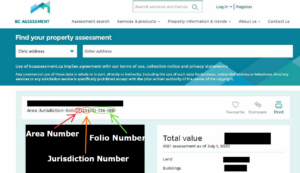

- Roll Number/Folio Number. It can be found on your tax notice, or on the BC Assessment property search website.

- Social Insurance Number

After you Apply

- Save your confirmation number. Note: it will also be emailed to you.

- You can check your application status on the BC Government’s website using your confirmation number here: https://www.etax.gov.bc.ca/btp/HOG/_/

Additional Information Regarding Homeowner Grants

- For full grant eligibility your property must be assessed under $1,625,000

- For properties assessed between $1,625,000 and $1,739,000, a partial grant is available *rural properties have a different value

- Capital Regional District (CRD), Metro Vancouver Regional District and the Fraser Valley

- Basic grant $570

- Seniors/Veteran/Person with Disabilities: $845

- All other areas of the province:

- Basic grant: $770

- Seniors/Veteran/Person with Disabilities: $1045

- Missed claiming your 2020 Homeowner grant application?

- You may retroactively apply here: https://www.etax.gov.bc.ca/btp/HOG/_/

- Property taxes are always due the 1st business Tuesday of every July

- Not sure where to locate your property’s jurisdiction or folio number? See the image below to see how you can locate them on BC Assessment’s website.

Questions

Q1: How will I know my homeowner grant has been applied?

A1: You can check the status of your application by calling an agent who will be able to look up your account and let you know if your homeowner grant has been applied to your account.

To speak with an agent you can call 250-387-0555 or toll-free at 1-888-355-2700.

***

Q2: What amount do I pay on my tax notice?

A2: The only change to homeowner grants is how you apply. Instead of applying through your municipality you apply directly through the province.

When you receive your property tax notice, you will see three distinct columns with calculated taxes for different eligibilities. Column A- not eligible for the grant, Column B –eligible for the regular grant, and Column C – seniors/additional grants.

For example, if you qualify for the Homeowner Grant, you will pay the amount calculated for Column B.

***

Q3: Will the BC Government send me a cheque for the amount of my homeowner grant?

A3: No cheque will be sent for the homeowner grant. You pay the tax owing in either column A, B, or C (depending on your eligibility) before the property tax due date. If you are eligible and applied for the homeowner grant, you will pay Column B’s calculated amount which factors in the homeowner grant.

If you pay for the full amount (Column A) but qualify for the homeowner grant you may apply for a refund. You must speak with an agent by calling 250-387-0555. Only then will a cheque be administered in the mail once the refund process is complete.

***

Q4: Is it better to wait to get my tax notice to do this?

A4: Yes, you should wait to receive your notice before applying for the grant. Applications will not be processed until after tax notices have been sent out.

Q5: Should I claim the grant if I am selling my house?

A5: Generally, yes. However, if your house has a firm contract for sale and/or is very close to your completion date (the day the legal transfer of ownership takes place) then check with your Notary Public or lawyer first.

****

Q6: Should I claim the grant if I am purchasing a house?

A6: You cannot claim before you own a house. Discuss this with your Notary Public or lawyer as the homeowner grant may have already been claimed by a seller of the property.

*****

Q7: What is the difference between the Capital Regional District and Capital Assessment Area?

A7: The Capital Regional District includes the 13 municipalities that make up Greater Victoria. These areas have a basic amount of $570.

Capital Assessment Area: they are the rural areas of the province overseen by the Ministry of Finance for tax purposes. They are the areas qualify for the higher grant of $770.

****

Q8: Are there any tips you think we should pass along?

A8: If you unsure about the new application process, you can speak with a representative at 250-387-0555 who will be happy to help you through the application process. And of course, do not forget to pay your taxes on time!

Leave a Reply

Want to join the discussion?Feel free to contribute!